We will comprehensively prepare and implement the company purchase transaction. For your comfort and safety, we will participate in every stage of the process – we coordinate the entire process, starting from determining your expectations, identifying optimal goals and their valuation, through coordinating the study due diligence ( risk analysis ), ending with negotiating the sales contract and supervising the closing of the transaction .

An efficient and professional post-transaction integration process is crucial to achieving the expected synergy effects and realizing the total value from the acquisition transaction. The Navigator team supports clients in developing and implementing an integration plan that is optimal from the investor’s point of view.

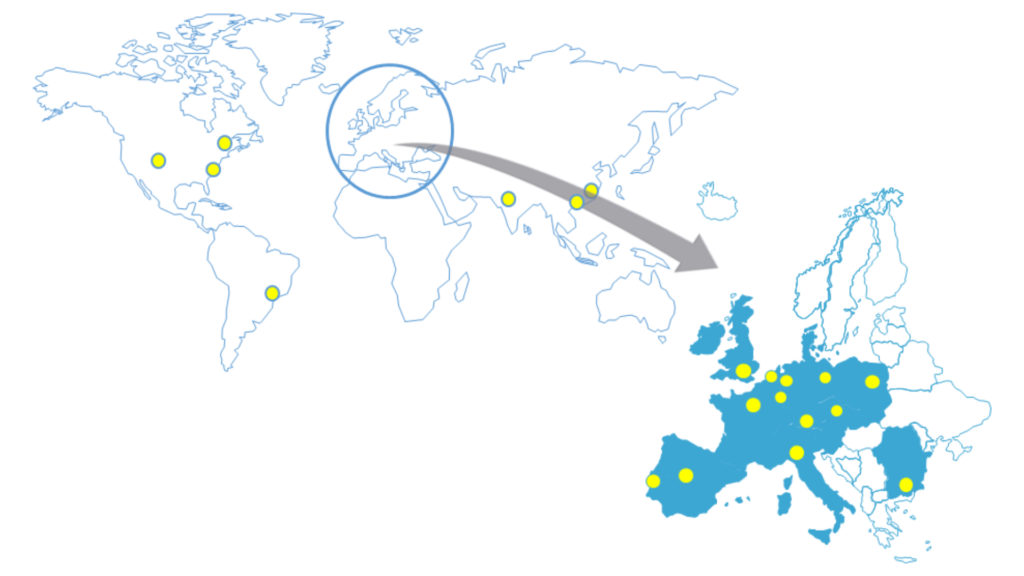

Thanks to cooperation with companies associated with the international Pandion Partners network, we are able to offer our clients access to the markets of Central and Eastern Europe, Western Europe, the United States, Canada, Brazil, Argentina, India and China.

We have also conducted numerous successful cross- border projects , both supporting the purchase of assets and searching for a foreign investor.

Director at Navigator Capital Group, head of the M&A department, member of the management board of Navigator Capital Advisory Sp. z o. o

Director at Navigator Capital Group, head of the M&A department, member of the management board of Navigator Capital Advisory Sp. z o. o

Manager at Navigator Capital Group

Manager at Navigator Capital Group

July 2023

April 2023

October 2023

July 2023

April 2023

January 2023