A merger or acquisition of another enterprise is an element of a strategy that allows companies to develop, strengthen their market position, increase competitiveness, and increase the market value of the business. M&A transactions are most often complex and their success depends on many variables.

The support of experienced transaction advisors allows you to go through the complicated and time-consuming process of merging or acquiring companies much more effectively. At the same time, it ensures risk minimization and implementation of activities in the most beneficial manner for the represented party to the transaction.

Navigator Capital Group offers comprehensive assistance in the area of mergers and acquisitions of companies, including the following activities:

We assist both in transactions carried out in Poland and on foreign markets.

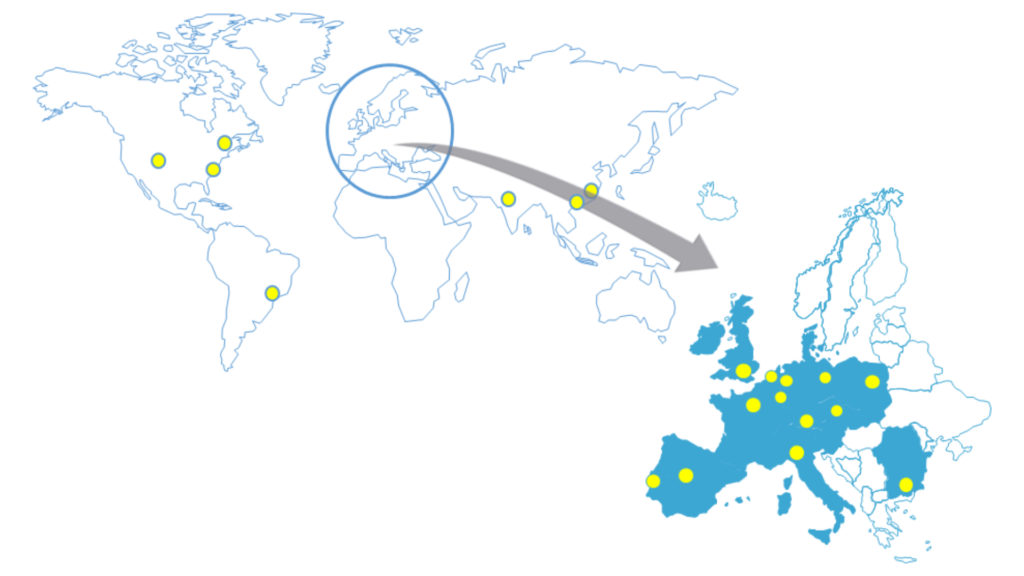

Thanks to cooperation with companies associated with the Pandion Partners network, we provide our clients interested in international M&A transactions with access to the markets of Central and Eastern Europe, Western Europe, the United States, Canada, Brazil, Argentina, India and China.

We have successfully completed many mergers and acquisitions projects in the cross-border model, supporting clients in both the purchase of assets and the search for a foreign investor.

Our mergers and acquisitions advisors provide specialist knowledge and support at every stage of M&A transactions. We help in efficient process management, maximizing the value of the transaction, reducing risks and securing the client’s interests.

Director at Navigator Capital Group, head of the M&A department, member of the management board of Navigator Capital Advisory Sp. z o. o

Director at Navigator Capital Group, head of the M&A department, member of the management board of Navigator Capital Advisory Sp. z o. o

Manager at Navigator Capital Group

Manager at Navigator Capital Group

July 2023

April 2023

October 2023

July 2023

April 2023

January 2023