Full analysis of the company in terms of finances and taxes

Reports and recommendations in written form

Analysis of the company’s documentation

Recommendation of pre-transaction activities

Full report with a discussion of the most important areas and threats

Full support of experts at every stage of due diligence

Other forms of support – depending on needs

Identification, assessment and minimization of financial risks related to the planned merger and acquisition transaction.

Support in the process of determining the financial conditions of the planned investment.

A complete and transparent financial picture of the analyzed company

Information about the structure of revenues,

company expenses and assets

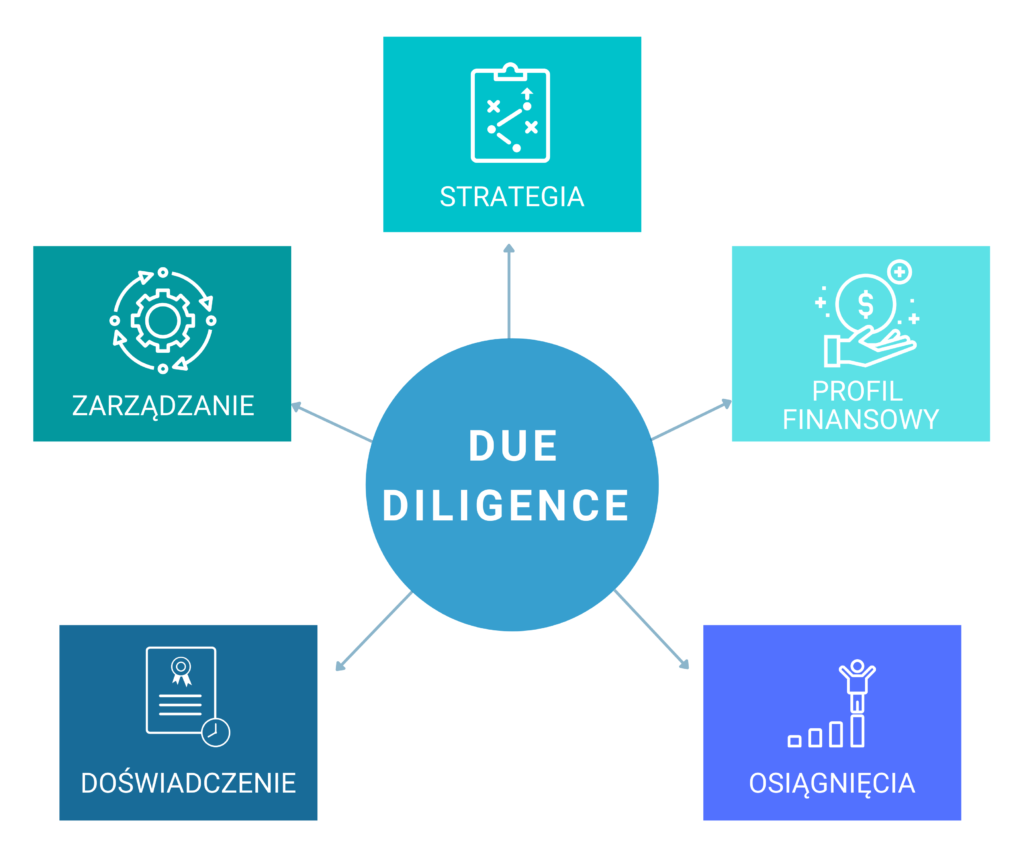

A number of factors influence the success and safety of transactions on capital markets, such as mergers, acquisitions or purchases of large blocks of shares. One of them is access to information, which is a basic condition for effective investing. Selecting appropriate information is not easy, and an additional difficulty is its asymmetry. In purchase-sale transactions, the buyer is exposed to additional risk resulting from the information advantage of the seller. One of the ways to reduce risk, which is the basis for a successful transaction and the starting point for an adequate valuation of the investment, is to properly conduct the due diligence process.

Due diligence is a comprehensive analysis of an enterprise , the purpose of which is to show the actual condition and condition of the organization, as well as to observe the existing and potential risks associated with the transaction. This allows for reducing the disproportion in the quality and quantity of information about a given company between the seller and the buyer.

Most often, due diligence is carried out before the transaction at the request and expense of the party interested in purchasing, in order to learn about the entity, the risks associated with running the enterprise and its acquisition, as well as to identify factors that could affect the sales price or the buyer’s potential benefit or loss. The seller, however, is obliged to provide the buyer with access to the information necessary to conduct the examination.

The survey carried out on behalf of the seller is the so-called vendor due diligence, used to identify problems that may be encountered by the party selling the enterprise. It allows you to minimize the risk of transaction failure and leads to achieving the most favorable conditions for the selling party. Moreover, it enables protection against disclosure of excessive amounts of information, because the report, by answering questions of interest to potential buyers, protects sensitive data and contacts. Vendor due diligence carried out by an external entity promotes an objective look at the tradable entity, its advantages and weaknesses, and also protects the seller against the risk of revealing a risk of which he was not aware and which affects the price, giving time and the opportunity to develop an appropriate position. negotiation.

Commercial due diligence usually focuses on three areas: analysis of sales, the market and the company’s competitive environment. It involves determining whether the business in which the examined company operates is future-proof from the investor’s point of view, and also allows for assessing the company’s chances for development in the long term, determining the company’s position against the competition and determining the current and future needs of customers.

The conclusions from the due diligence analysis enable an appropriate decision to be made regarding the use of financial resources for the purchase of the enterprise, and also constitute an irrefutable argument in negotiations regarding the final transaction price. Moreover, the research report is a good basis for determining the company’s development strategy after the transaction.

Navigator Business Consulting conducts both commercial and financial due diligence , each time tailored and individualized for each company. Commercial due diligence usually focuses on three areas: analysis of sales, the market and the company’s competitive environment. It involves determining whether the business in which the examined company operates is future-proof from the investor’s point of view, and also allows for assessing the company’s chances for development in the long term, determining the company’s position against the competition and determining the current and future needs of customers. Financial due diligence allows you to obtain detailed knowledge about the company and guarantees correct valuation. Its basis is mainly accounting evidence. This study aims to confirm the reliability of the financial statements provided by the company, determine the actual margins achieved by the company and verify whether the financial results presented in the investment business plan are consistent with the current situation of the company.

The conclusions from the due diligence analysis enable an appropriate decision to be made regarding the use of financial resources for the purchase of the enterprise, and also constitute an irrefutable argument in negotiations regarding the final transaction price. Moreover, the research report is a good basis for determining the company’s development strategy after the transaction.